Amazon just made its biggest bet on India yet. On December 10, 2025, the company announced an additional $35 billion investment in India through 2030—more than double what Microsoft pledged the day before. This pushes Amazon’s total India commitment to a staggering $75 billion, cementing its position as the largest foreign investor in the country.

But here’s what makes this announcement different: it’s not just about e-commerce anymore. Amazon is going all-in on artificial intelligence, promising to bring AI tools to 15 million small businesses and AI education to 4 million government school students. With Microsoft and Google making their own massive pledges, India has become ground zero for the global AI race.

So what does this mean for India’s economy, small businesses, and the millions of workers hoping to ride the AI wave? Let’s break it all down.

The Big Tech race for India heats up

Amazon’s announcement didn’t happen in a vacuum. Just one day earlier, Microsoft CEO Satya Nadella met with Prime Minister Narendra Modi and pledged $17.5 billion over four years—the company’s largest investment in Asia. Two months before that, Google committed $15 billion to build a gigawatt-scale AI hub in Visakhapatnam, Andhra Pradesh.

Combined, these three tech giants have pledged over $67 billion in new investments within a two-month period. That’s roughly ₹6.12 lakh crore flooding into India’s digital economy.

Why the sudden rush? The answer lies in India’s unique position. With 1.4 billion people, the world’s largest young workforce, and rapidly growing AI adoption, India offers what no other market can: scale. Add in government initiatives like the IndiaAI Mission and increasingly favorable policies, and you’ve got a recipe for tech investment gold.

Deepika Giri of IDC put it simply: “India is a pivotal market and one of the fastest-growing regions for AI spending in Asia Pacific. A major gap—and therefore a significant opportunity—lies in the shortage of suitable compute infrastructure for running AI models.”

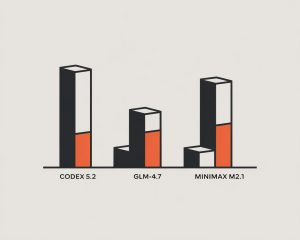

How Amazon, Microsoft, and Google compare

Understanding the scale of these investments requires looking at them side by side. Each company is taking a distinctly different approach to capturing India’s AI opportunity.

| Company | New Investment | Timeline | Total Commitment | Primary Focus |

|---|---|---|---|---|

| Amazon | $35 billion | By 2030 | ~$75 billion | E-commerce, Cloud, AI, Exports |

| Microsoft | $17.5 billion | 2026-2029 | ~$20.5 billion | Cloud, AI Skills, Sovereign Solutions |

| $15 billion | 2026-2030 | ~$25 billion | AI Infrastructure, Data Centers |

Amazon’s investment is twice the size of Microsoft’s and more than double Google’s new commitment. But the differences go beyond raw numbers.

Microsoft is betting heavily on workforce development, promising to train 20 million Indians in AI skills by 2030. The company is also integrating AI into government platforms like e-Shram and the National Career Service, potentially benefiting over 310 million informal workers.

Google is taking an infrastructure-first approach, building India’s first gigawatt-scale AI data center in partnership with AdaniConneX and Bharti Airtel. This single facility could create nearly 188,000 direct and indirect jobs, according to Andhra Pradesh’s Chief Minister.

Amazon is playing the broadest game—spanning retail, cloud computing, logistics, and AI. The company’s strategy rests on three pillars: AI-driven digitization, export acceleration, and massive job creation.

Amazon’s three-pillar strategy for India

Amazon isn’t just writing checks. The company has laid out a detailed roadmap with specific, measurable targets for 2030. Here’s what each pillar involves:

AI-driven digitization for 15 million small businesses

Amazon’s most ambitious promise? Bringing AI tools to 15 million Indian small businesses by 2030. That’s up from the 12 million businesses the company has already helped digitize.

The AI toolkit includes several already-deployed products:

- Seller Assistant: A generative AI tool with “agentic AI capabilities” that provides instant answers and understands each seller’s unique business context

- Rufus: An AI shopping assistant that helps customers discover products, compare prices, and get personalized recommendations—already used by 250 million shoppers globally in 2025

- Creative Studio: AI-powered tools for creating product ads without professional design skills

- Generative AI Listing Tools: Create complete product listings from just a short description, image, or website link

These tools matter because they address a fundamental challenge. As Samir Kumar, Amazon India’s Country Manager, explained: “AI has the potential to be the great equalizer in India, breaking down barriers of language, literacy, and access that have historically held people back.”

Quadrupling exports to $80 billion

Amazon has already helped Indian sellers export $20 billion worth of products globally—a target originally set for 2025 that was achieved ahead of schedule. Now they’re aiming for $80 billion in cumulative e-commerce exports by 2030.

The “Accelerate Exports” program is targeting specific manufacturing clusters:

- Tirupur (textiles and apparel)

- Kanpur (leather goods)

- Surat (diamonds and textiles)

Through Amazon Global Selling, over 200,000 Indian exporters have already shipped 750 million “Made in India” products to customers worldwide. Programs like Easy Ship and Seller Flex are helping even small manufacturers reach international markets without setting up complex logistics operations.

Creating 1 million additional jobs

Amazon currently supports 2.8 million jobs in India—including direct employees, indirect workers, and seasonal staff across logistics, packaging, transportation, and manufacturing. By 2030, that number is expected to reach 3.8 million, adding approximately 1 million new positions.

These aren’t just warehouse jobs. Amazon is also committing to AI education for 4 million government school students, preparing the next generation for careers in technology. The program includes curriculum development, teacher training, and hands-on AI sandbox experiences aligned with India’s National Education Policy 2020.

Where exactly is Amazon’s money going?

Let’s follow the dollars. Amazon has already invested approximately $40 billion in India since entering the market in 2010. The new $35 billion breaks down across several major categories.

AWS Cloud Infrastructure: $12.7 billion

Amazon Web Services (AWS) is pouring $12.7 billion into data center infrastructure across two regions:

The AWS Asia Pacific (Mumbai) Region is receiving $8.3 billion, formalized through a Memorandum of Understanding with Maharashtra’s government at Davos in January 2025. By 2030, AWS expects this region to contribute $15.3 billion to India’s GDP and support 81,300 full-time equivalent jobs annually.

The AWS Asia Pacific (Hyderabad) Region, launched in November 2022, is receiving approximately $4.4 billion. It already operates three availability zones and is expected to add $7.6 billion to GDP and create 48,000 additional jobs by 2030.

A major partnership with Tata Communications is building a national backbone network connecting AWS data centers in Mumbai, Hyderabad, and Chennai. This AI-optimized infrastructure will support generative AI workloads, 5G applications, and large-scale model training.

E-commerce and Logistics

Amazon operates over 60 fulfillment centers in India and is rapidly expanding its quick-commerce operations. The company’s “Amazon Now” service plans to have 300 dark stores operational by the end of 2025, competing directly with Zepto and Blinkit.

What the government is saying

India’s government has responded enthusiastically to the investment wave. Prime Minister Narendra Modi met with Amazon CEO Andy Jassy in 2023 to discuss the company’s commitment to startups, job creation, and exports. His response to Microsoft’s investment was equally positive: “When it comes to AI, the world is optimistic about India!”

Union Minister Ashwini Vaishnaw, who oversees Electronics and IT, framed Microsoft’s investment as validation of India’s AI ambitions: “This partnership will set new benchmarks and drive the country’s leap from digital public infrastructure to AI public infrastructure.”

The timing aligns perfectly with India’s own investments in AI. The IndiaAI Mission has allocated ₹10,372 crore (approximately $1.25 billion) over five years to build computing infrastructure, including 18,693 GPUs with subsidized access for researchers and startups. Sarvam AI was selected in April 2025 to develop India’s first sovereign large language model (IT WAS A DISASTER).

Amazon’s senior leadership has been careful to align their messaging with government priorities. Amit Agarwal, SVP of Emerging Markets, emphasized that “Amazon’s growth in India perfectly aligned with the vision of an Atmanirbhar and Viksit Bharat”—using the Hindi phrases for “self-reliant” and “developed” India that are central to Modi’s economic agenda.

India’s position in the global AI race

These investments are landing in fertile ground. According to the Stanford AI Index, India now ranks among the top four countries globally in AI vibrancy, alongside the United States, China, and the United Kingdom.

The numbers tell a compelling story:

- GitHub ranks India #1 globally with a 24% share of all AI projects

- India’s AI market is projected to grow from $21.65 billion in 2024 to $257 billion by 2035

- 93% of Indian organizations plan to increase AI investments in 2025

- The country has 420,000 AI professionals, with demand for 600,000+

What’s driving this growth? India produces 800,000+ engineering graduates annually—roughly six times the United States. The country also holds over 20% of the global semiconductor design workforce, making it a natural hub for AI development.

But challenges remain. Only 42.6% of Indian graduates are employable according to recent assessments, and Coursera’s 2025 Global Skills Report ranked India 89th out of 109 countries for overall skills proficiency. This explains why companies like Microsoft are prioritizing skills training alongside infrastructure investment.

The competitive landscape Amazon faces

Amazon isn’t investing $35 billion just for growth—it’s fighting to maintain market share. In India’s e-commerce sector, Flipkart (backed by Walmart) controls approximately 48% of the market compared to Amazon’s 31-35%. The competition is intensifying, not easing.

Quick-commerce represents the newest battleground. Blinkit, Zepto, and Swiggy Instamart have captured Indian consumers with promises of 10-minute grocery delivery. Amazon’s response—the Amazon Now service with 300 planned dark stores—is playing catch-up in a market segment growing at over 100% annually.

Meanwhile, Reliance Industries continues expanding its JioMart platform, leveraging its massive retail footprint and telecom customer base. For Amazon, the $35 billion investment isn’t optional—it’s essential for staying competitive.

What this means for small businesses and job seekers

If you’re running a small business in India, Amazon’s investment could be transformative. The company is essentially promising to make enterprise-grade AI tools available to corner shops and home-based manufacturers. AI-powered pricing, demand forecasting, and multilingual customer service could level the playing field against larger competitors.

For job seekers, the picture is mixed but promising. Amazon’s commitment to 1 million additional jobs and 4 million students trained in AI suggests significant opportunities—but mostly for those with digital skills. The World Economic Forum estimates that 63 in every 100 Indian workers will require retraining by 2030 to remain employable.

The biggest winners may be export-oriented businesses in targeted clusters like Tirupur, Kanpur, and Surat. Amazon’s logistics network and global reach can transform a local manufacturer into an international brand—something previously accessible only to large corporations.

Expert predictions for what comes next

Industry analysts are cautiously optimistic about the investment wave’s impact. Tarun Pathak of Counterpoint Research noted that massive capital expenditure on “GPU-rich data centers” gives these companies first-mover advantages in AI workloads that will be difficult to replicate.

However, some experts urge caution. India’s R&D spending equals just 0.6% of GDP, with nearly 75% coming from the public sector. Unlike the U.S. or China, India lacks major domestic AI infrastructure companies. As S. Krishnan, Secretary of the Ministry of Electronics and IT, acknowledged: “India’s opportunity lies more in developing applications which will be used to drive revenues for AI companies” rather than building foundational AI models.

The next 12-18 months will be critical. Will these investments translate into actual infrastructure? Will small businesses adopt AI tools at scale? Will the promised jobs materialize?

One thing is certain: India has never seen this level of coordinated investment from global tech giants. The decisions made in boardrooms in Seattle, Redmond, and Mountain View will shape the economic prospects of hundreds of millions of Indians for decades to come.

The bottom line

Amazon’s $35 billion India investment represents more than corporate expansion—it’s a bet that India will become a global AI powerhouse. Combined with Microsoft’s $17.5 billion and Google’s $15 billion, over $67 billion in new tech investment is flowing into a country that’s simultaneously the world’s largest democracy, its most populous nation, and one of its fastest-growing economies.

For Amazon, the investment secures its position as India’s largest foreign investor while preparing for an AI-driven future where e-commerce, cloud computing, and artificial intelligence converge. For India, it’s validation of a decade of digital infrastructure building and an opportunity to leapfrog into the AI age.

The race is on. And right now, everyone is betting on India.

Frequently Asked Questions

How much is Amazon investing in India by 2030? Amazon announced an additional $35 billion investment in India through 2030, bringing its total planned commitment to approximately $75 billion.

Is Amazon the largest foreign investor in India? Yes. According to the Keystone Strategy report cited by Amazon, the company is the largest foreign investor in India based on publicly available data.

How many jobs will Amazon create in India? Amazon currently supports 2.8 million jobs in India and expects to support 3.8 million jobs by 2030—an addition of approximately 1 million positions.

What AI tools is Amazon offering to Indian businesses? Amazon offers several AI tools including Seller Assistant (generative AI business assistant), Rufus (AI shopping assistant), Creative Studio (AI ad creation), and generative AI product listing tools.

How does Amazon’s investment compare to Microsoft and Google? Amazon’s $35 billion new commitment is roughly double Microsoft’s $17.5 billion (announced December 2025) and more than double Google’s $15 billion (announced October 2025).